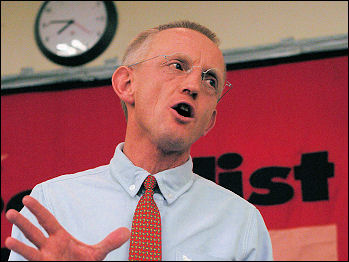

A statement by Jerry Hicks on the threat to jobs at RBS. Jerry Hicks is a member of Amicus and was a candidate in that union’s General Secretary election

A statement by Jerry Hicks on the threat to jobs at RBS. Jerry Hicks is a member of Amicus and was a candidate in that union’s General Secretary election

RBS: Low-paid Workers Pay The Price For “Fat Cat” Banking Crisis

Royal Bank of Scotland releases its quarterly results to the city after two shocking days for the workers where earlier this week RBS announced that 3,700 jobs are to be cut from UK branches.

Whilst large areas of the business are to be separated and sold off, including insurance, card payments, and over 320 branches, with no guarantees for the jobs of the tens of thousands of employees involved.

This is in addition to the 9,000 global job losses announced in April across RBS’s manufacturing division – the “back-office” operation of call centres, data processing and IT.

4,500 of these losses will be in the UK, and 600 have already gone in the UK IT department (roughly 20% of staff).

Piling on the pain, RBS’ decided in August to freeze the value of its “final salary” pension scheme at current levels of pay. With negligible recognition of any future pay rises.

This has been what the Government’s £45.5 billion bail-out has meant for call-centre agents, processing clerks and operational staff. Despite the bank’s image, the vast majority of the workers impacted by these attacks are low-paid and vulnerable.

Where has the money gone? Most of the money has been used to stop RBS going bankrupt, by improving liquidity and providing reserves of capital to offset against bad debt.

Yet the Government has stubbornly refused to intervene in the running of the bank, to leverage their 84% stake to make the bank serve society’s interests through and beyond the recession.

Even now, Alistair Darling will not guarantee that the Government’s modest targets for lending to families and small businesses will be met.

It is less well known that RBS plans to spend £10 billion over the next 5 years in a huge and highly risky investment programme to reduce operational costs through further job losses. RBS is targeting cost reductions of £2.5 billion per year, and it would seem to be our public money that is funding this aggressive attack on vital jobs, at a time of high and growing unemployment.

Jerry Hicks said “It is RBS’s workforce who are paying the price for the banking crisis, not the banking ‘fat cats’ who are already popping champagne bottles across the City again, while their staff will have to fight to protect their jobs, pensions and conditions.”

Unite is calling for a “Yes” vote in a consultative ballot over industrial action to stop the pension freeze, following on from a 98% vote amongst Barclays staff to protect their own pensions.

Jerry Hicks calls on the Government to “stop this jobs massacre by nationalising the bank, making it a public utility to serve the public interest, and one that continues to provide employment across the community. It has never been more obvious that we need a bank driven by social need rather than private greed.”

Ends: Notes to editor: Jerry Hicks legal challenge forced the election for General Secretary in the UK’s biggest union Unite Amicus this year in which he finished runner up. He is thought of as being a possible winner of next years election of the whole of Unite and is being urged by many to stand. For further information visit JerryHicks4gs.com

Jerry Hicks Can be contacted on:

Tel: 078 178 279 12

email jo@benefield.force9.co.uk

To visit Jerry Hick’s website click here

I’m not surprised that Britain’s banks were particularly hard hit by the financial crisis. In July 2007, on the eve of the financial melt-down, I wrote: “The hirelings of Britain’s financial oligarchy openly take pride in the usurious nature of British imperialism. Thus Christopher Smallwood, in a report prepared for the British Bankers’ Association, blurted out the following pearl: ‘…Britain’s international banking system has achieved unparalleled success in generating a surplus of investment income, essentially gathering deposits from the rest of the world and lending them out at significantly higher rates. In relation to its size, the UK has been the most successful country in the world in generating net investment income… Britain’s role as world banker, borrowing cheap and lending dear, appears to have become structural, and as globalisation proceeds the financial sector can be expected to make a steadily rising contribution to the [UK] balance of payments.'” (See ‘Modern-day Kautskyism’, by Alec Abbott, p187, http://www.rosclar.webspace.virginmedia.com)

The correct website address for Alec Abbott’s ‘Modern-day Kautskyism’ is http://www.rosclar.webspace.virginmedia.com